North Carolina Businesses Shift to Outsourced Finance and Accounting Solutions

Find out how North Carolina businesses are using finance and accounting outsourcing solutions to streamline operations.

With evolving tax policies, stringent compliance requirements, and a growing demand for cybersecurity measures, many companies are looking for external expertise to manage their financial operations. The tight labour market for skilled finance professionals has further accelerated this shift, prompting organizations to explore outsourcing as a viable solution.

Industry observers note a steady rise in businesses outsourcing critical financial functions such as bookkeeping, tax preparation, and financial reporting. The trend reflects a broader effort by companies to maintain financial stability while focusing on core operations.

Focus on Your Business—Let Us Handle Your Finances. Talk to Us Today!

https://www.ibntech.com/free-consultation/?pr=EINT5

Experts suggest that this move toward finance and accounting outsourcing solutions is not solely about reducing costs but also about ensuring accuracy, compliance, and adaptability in a rapidly changing business landscape. As organizations continue to adjust to shifting economic conditions, the demand for outsourced finance and accounting services is expected to grow.

Ajay Mehta, CEO of IBN Technologies, explains, “In a dynamic business world, outsourcing finance and accounting ensures compliance, cuts costs, and drives growth.”

As workforce expenses rise and regulatory demands intensify, businesses in North Carolina are increasingly adopting finance and accounting outsourcing to streamline operations and maintain compliance. By working with specialized service providers, companies can enhance efficiency, manage financial processes more effectively, and focus on innovation and expansion—allowing them to stay competitive in a rapidly changing economic landscape.

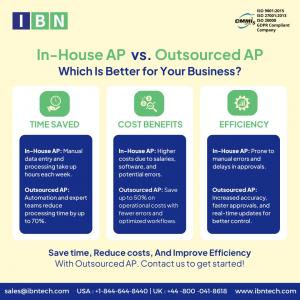

Traditional financial management systems are becoming less effective under mounting economic and regulatory pressures, leading to issues such as delayed reporting, transaction errors, and cash flow disruptions. For businesses experiencing rapid growth or seasonal demand shifts, scaling financial operations presents additional challenges. Outsourcing finance and accounting functions offers a flexible, technology-driven approach that helps optimize cash flow, improve financial planning, and mitigate risks. By delegating essential tasks like payroll, tax compliance, and financial reporting to external specialists, businesses can control costs, increase operational agility, and adapt quickly to market fluctuations—without expanding their in-house finance teams.

The use of advanced technology and automation in outsourced financial services ensures accuracy, compliance, and efficiency across industries. Healthcare providers rely on these solutions for HIPAA compliance and claims processing, while real estate companies benefit from automated lease accounting. Retail and e-commerce businesses refine tax strategies, and manufacturing and logistics firms depend on outsourcing to manage expenses and meet regulatory requirements.

By adopting customized outsourcing solutions, businesses can strengthen financial management and improve operational efficiency, positioning themselves for long-term success both locally and internationally.

“India is a leading destination for finance and accounting outsourcing, providing skilled professionals, cost-effective solutions, and expertise in GAAP and IFRS to ensure accurate financial processes.” says Ajay Mehta, CEO of IBN Technologies.

Cloud-based finance and accounting outsourcing solutions are revolutionizing business operations in North Carolina, enhancing data accessibility, automating invoicing, and bolstering security. These advancements ensure financial services are not only accurate and compliant but also more efficient. With the power of advanced analytics, businesses can refine budgeting, assess risks, and enhance strategic planning. Through these innovations, IBN Technologies continues to empower businesses with the tools they need to maintain financial stability, meet compliance requirements, and navigate the evolving economic landscape.

The role of finance and accounting outsourcing has shifted from a mere support function to a key enabler of business growth. More companies are leveraging external expertise to manage their financial processes, allowing internal teams to focus on critical initiatives such as expansion strategies, mergers, acquisitions, and market positioning. This transformation enables CFOs and financial leaders to direct their attention to high-level strategic planning while skilled professionals handle the complexities of daily financial operations.

Get a Customized Quote! request pricing today.

https://www.ibntech.com/pricing/?pr=EINT5

Businesses across North Carolina, from startups to multinational corporations, are turning to outsourced finance teams for accurate financial insights, improved efficiency, and seamless operations. Amid ongoing economic uncertainty, outsourcing financial services has emerged as a crucial approach to reducing risks and ensuring long-term financial stability.

As labour shortages impact businesses across North Carolina and the U.S., companies are increasingly turning to outsourced finance and accounting services to maintain efficiency. IBN Technologies, a key player in the sector, offers cost-effective solutions to streamline financial processes while addressing data security and compliance concerns.

The shift toward outsourcing comes as businesses face mounting pressure to reduce costs and improve financial accuracy. With advancements in cloud-based accounting, automation, and data analytics, financial operations are becoming more efficient and resilient. These technologies also help strengthen compliance measures, a critical factor in today’s complex regulatory environment.

Industry analysts highlight outsourcing as a strategic move for companies seeking scalable and secure financial solutions. IBN Technologies continues to support businesses with the tools needed to navigate economic shifts and ensure long-term stability.

Source:

Outsourcing Finance and Accounting Services | IBN Technologies

https://www.ibntech.com/article/outsourced-finance-and-accounting-services-usa/?pr=EINT5

Explore More Services:

USA Bookkeeping Services

https://www.ibntech.com/bookkeeping-services-usa/?pr=EINT5

Account Payable and Account Receivable Services

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/?pr=EINT5

Tax Filing in the United States Guide

https://www.ibntech.com/article/us-tax-filing-2025-guide/?pr=EINT5

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release