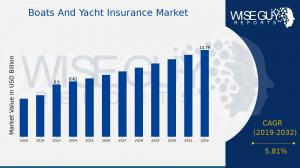

Boats and Yacht Insurance Market Expected to Reach $14.8 Billion by 2032

Boats And Yacht Insurance Market Research Report By Type of Boat or Yacht ,Size of Boat or Yacht ,Usage ,Coverage Type ,Policy Type ,Regional- Forecast to 2032.

CA, UNITED STATES, January 11, 2025 /EINPresswire.com/ -- The boats and yacht insurance market is experiencing steady growth, driven by the rising number of recreational boating activities, increased boat ownership, and advancements in the marine insurance sector. As of 2023, the market size was estimated at USD 8.9 billion, with projections to grow at a robust pace. The market is expected to reach USD 14.8 billion by 2032, with a compound annual growth rate (CAGR) of 5.81% during the forecast period from 2024 to 2032.This growth trajectory can be attributed to several factors, including the growing demand for recreational boating, the need for risk mitigation, and the evolution of insurance products tailored to the specific needs of boat and yacht owners. Moreover, the increase in luxury boat ownership, technological advancements in marine safety, and a focus on asset protection are contributing to the overall market expansion.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬

https://www.wiseguyreports.com/sample-request?id=542785

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐁𝐨𝐚𝐭𝐬 𝐚𝐧𝐝 𝐘𝐚𝐜𝐡𝐭 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐜𝐥𝐮𝐝𝐞:

• AXA XL

• Chub

• Markel

• Zurich

• AIG

• Liberty Mutual

• Travelers

• Progressive

• Nationwide

• Safeco Insurance

• State Farm

• Farmers Insurance

• Allstate Insurance

• USAA

• Geico

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 (𝟏𝟏𝟎 𝐏𝐚𝐠𝐞𝐬) 𝐨𝐧 𝐁𝐨𝐚𝐭𝐬 𝐚𝐧𝐝 𝐘𝐚𝐜𝐡𝐭 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭:

https://www.wiseguyreports.com/reports/boats-and-yacht-insurance-market

𝐊𝐞𝐲 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐁𝐨𝐚𝐭𝐬 𝐚𝐧𝐝 𝐘𝐚𝐜𝐡𝐭 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

The boats and yacht insurance market can be segmented based on type of insurance, end-user, and region. Let’s take a closer look at these key segments.

Type of Insurance

The market can be broadly divided into two major types of insurance:

Hull Insurance:

This segment covers damage to the boat or yacht itself, including accidents, weather-related incidents, and collisions. Hull insurance is one of the most crucial aspects of boat insurance as it provides protection against costly repairs or replacements in case of damage to the vessel.

Liability Insurance:

Liability insurance provides coverage for accidents involving third parties. It includes property damage, bodily injury, or death caused by the insured boat or yacht. This type of coverage is especially important for boat owners who operate in busy or crowded waterways where the risk of accidents is higher.

Comprehensive Insurance:

Comprehensive policies combine hull and liability insurance, along with additional protections such as coverage for theft, fire, and vandalism. These policies are typically preferred by yacht owners who require a broad range of coverage for both their vessel and their liabilities.

Other Types of Insurance:

This includes coverage for personal property on board, crew insurance, and insurance for special equipment or machinery used on the boat or yacht.

End-User

The market is also segmented by the type of end-user:

Individual Boat Owners:

This segment includes recreational boat owners who use boats or yachts for personal purposes such as leisure, sports, or vacations. As the number of recreational boaters increases, individual boat owners form a significant portion of the market.

Commercial Boat Operators:

Commercial boat owners, such as those running boat tours, fishing charters, and other marine businesses, require insurance to protect their assets. They often require more extensive coverage due to the higher risks involved in their operations.

Fleet Owners:

Fleet owners, who operate multiple boats or yachts for either commercial or personal purposes, also constitute a growing segment. Fleet owners often opt for customized insurance packages to cover the entire fleet, which can be more cost-effective compared to insuring each vessel separately.

Geographic Segmentation

The boats and yacht insurance market is further segmented based on geographic regions. Key regions include:

North America:

North America is one of the largest markets for boat and yacht insurance, driven by high levels of recreational boating activity, especially in the United States and Canada. With millions of boats in operation and an increasing number of luxury yachts, the demand for comprehensive insurance policies is on the rise.

Europe:

Europe is another significant market for boats and yacht insurance. Countries like the UK, Germany, Italy, and France have a strong boating culture, and the demand for yacht insurance is driven by a mix of leisure boating and the presence of high-net-worth individuals seeking luxury yachts.

Asia-Pacific (APAC):

The APAC region is seeing rapid growth in the boating industry, particularly in countries like China, Japan, Australia, and Southeast Asia. The rise in disposable income, the popularity of boating as a leisure activity, and the increase in commercial maritime activities are driving the demand for boats and yacht insurance in this region.

Rest of the World:

Other regions, such as Latin America, the Middle East, and Africa, are also witnessing growth in the boating market. While the adoption of insurance may be slower in these regions, the growing popularity of recreational boating and tourism will drive the market in the long term.

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐭𝐡𝐞 𝐁𝐨𝐚𝐭𝐬 𝐚𝐧𝐝 𝐘𝐚𝐜𝐡𝐭 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

Several key factors are driving the growth of the boats and yacht insurance market:

Rising Popularity of Recreational Boating:

As recreational boating becomes more popular worldwide, more individuals are seeking insurance to protect their boats and yachts. The demand for luxury yachts, in particular, is driving an increase in high-value insurance policies.

Increased Boat Ownership:

The number of boats in operation, including yachts, sailboats, motorboats, and others, has been steadily increasing. With more boats on the water, the need for boat and yacht insurance is growing.

Technological Advancements in Marine Safety:

The adoption of new technologies in boats and yachts, such as GPS tracking, automated safety systems, and advanced communication tools, is contributing to greater safety. This encourages more boat owners to invest in comprehensive insurance coverage.

Environmental Risks:

With the increasing unpredictability of weather patterns due to climate change, boat owners are more concerned about potential environmental damage to their vessels, driving demand for insurance policies that cover weather-related damages.

Regulatory Compliance:

In many countries, boat and yacht insurance is a legal requirement for operating a vessel in commercial waters or for yachts exceeding a certain size. This regulatory pressure is pushing more boat owners to secure insurance policies.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰:

https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=542785

𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐅𝐚𝐜𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

While the boats and yacht insurance market is growing, there are a few challenges that could impact the industry:

High Premiums for Luxury Yachts:

Luxury yachts, in particular, require high-value insurance policies, which can come with steep premiums. This can deter some potential yacht owners from purchasing coverage.

Risk of Fraud:

As with any insurance market, fraud is a challenge. Insurance providers need to implement robust fraud detection systems to mitigate the risk of fraudulent claims in the boating and yacht sector.

Complexity of Policies:

Understanding the different types of insurance policies and selecting the right coverage can be complex for boat owners. The lack of clear communication and the availability of custom insurance packages can sometimes confuse consumers.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭:

Enterprise Hdd Market https://www.wiseguyreports.com/reports/enterprise-hdd-market

Rugged Handheld Computers Market https://www.wiseguyreports.com/reports/rugged-handheld-computers-market

Fpga Module Market https://www.wiseguyreports.com/reports/fpga-module-market

Propane Tank Level Sensor Market https://www.wiseguyreports.com/reports/propane-tank-level-sensor-market

Fluorescent Light Ballast Market https://www.wiseguyreports.com/reports/fluorescent-light-ballast-market

Field Termination Plug Market https://www.wiseguyreports.com/reports/field-termination-plug-market

Plcc Socket Market https://www.wiseguyreports.com/reports/plcc-socket-market

Industrial Lcd Monitor Market https://www.wiseguyreports.com/reports/industrial-lcd-monitor-market

𝐀𝐛𝐨𝐮𝐭 𝐖𝐢𝐬𝐞 𝐆𝐮𝐲 𝐑𝐞𝐩𝐨𝐫𝐭𝐬

𝖠𝗍 𝖶𝗂𝗌𝖾 𝖦𝗎𝗒 𝖱𝖾𝗉𝗈𝗋𝗍𝗌, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new Market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

WiseGuyReports (WGR)

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release