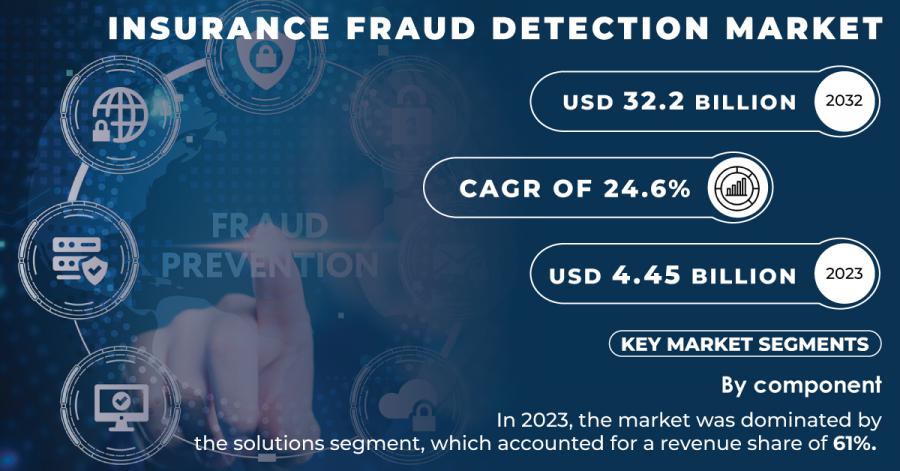

Insurance Fraud Detection Market to USD 32.2 Billion by 2032, Owing to Increasing Fraud Activities in Insurance Sector

Rising incidents of insurance fraud, along with the demand for real-time detection and prevention solutions, are driving the rapid growth of market.

AUSTIN, TX, UNITED STATES, November 25, 2024 /EINPresswire.com/ -- The SNS Insider report indicates that the global Insurance Fraud Detection Market was valued at USD 4.45 billion in 2023 and is expected to grow to USD 32.2 billion by 2032, with a compound annual growth rate (CAGR) of 24.6% over the forecast period from 2024 to 2032.

Increasing incidences of fraud in the insurance industry are the major factors that are driving the demand for insurance fraud detection solution. With an increase in fraudulent claims, insurers are implementing innovative technologies like artificial intelligence (AI), machine learning (ML) and data analytics for their detection, prevention and management. The technologies empower insurers to conduct real time data extraction at a large scale, thus making it possible to detect fraud more accurately and with lesser human intervention. Secondly, the increasing digital transition and the broader use of digital platforms for insurance services have created additional opportunities for fraudsters to misuse services. Therefore, the demand for advanced, automated systems designed to efficiently and accurately recognize fraudulent patterns is ever-increasing. As fraud scheme grows more complex, traditional fraud detection methods are no longer effective. As a result, there is a burgeoning market for high-tech fraud detection tools that support real-time monitoring, predictive analytics, and intelligent detection systems.

Get Sample Copy of Report: https://www.snsinsider.com/request-analyst/4653

Keyplayers:

FICO (FICO Falcon Fraud Manager, FICO Insurance Fraud Solution)

IBM Corporation (IBM Safer Payments, IBM Counter Fraud Management)

SAS Institute Inc. (SAS Fraud Framework, SAS Detection and Investigation for Insurance)

Oracle Corporation (Oracle Insurance Fraud Analytics, Oracle Financial Services Analytical Applications)

SAP SE (SAP Fraud Management, SAP Business Integrity Screening)

DXC Technology (DXC Fraud Detection Solution, DXC Insurance Suite)

Experian plc (Experian Fraud Risk Management, Experian Fraud Shield)

BAE Systems (NetReveal Fraud Detection, BAE Systems Fraud Detection Platform)

Shift Technology (Force Fraud Detection, Shift Claims Fraud Detection)

ACI Worldwide (ACI Fraud Management for Insurance, ACI Enterprise Payments Fraud Management)

This adoption of machine learning and AI in fraud detection systems also contributes to the market growth. They have the ability to learn from past data, adapt to new fraud patterns, and improve the detection process over time. Additionally the rising need for regulatory compliance and the insurers' need to safeguard their profitability are leading them to invest in fraud detection technologies. Government regulation mandating insurers to strengthen fraud prevention mechanisms is also supporting the market.

Enquiry Before Buy: https://www.snsinsider.com/enquiry/4653

Growing business demand and changing consumer behaviors are several key growth drivers in this market. The increasing penetration of AI, machine learning, and big data analytics in fraud detection systems is one of the key factors boosting the growth of the market. Such technologies can help automate processes of fraud detection, making it easier and faster to detect complex schemes of fraud. In addition, the constantly evolving nature of fraud is prompting insurance companies to look for new, advanced fraud prevention solutions. In terms like medical fraud, auto insurance fraud, and property insurance fraud, the claims became advanced and fake, and thus, advanced algorithms are needed to detect possible fraud before it occurs, and predictive analytics can check large amounts of data in real time, as per needs arising. In addition, pressures for the insurance industry to improve operational efficiency are also propelling the adoption of fraud control and prevention technologies.

Segmentation Analysis

By Deployment

The largest revenue share of global industry in 2023 was held by the on-premise deployment. Fraud can be detected within seconds, as existing on-premise fraud detection solutions help businesses recognize and notify potential fraud threats instantly. To identify specific threat patterns, the vendors offer a rule-based system, predictive behavioural scoring model, or a combination of the two. For instance, FICO Falcon Fraud Manager 6.5.2, keeps the customer data secure, improves customer experience, and prevents loss. However, certain reports in the organization will support automated systems with a human touch to process it. As a result, companies mostly rely on onsite- solutions as opposed to cloud-based.

The cloud deployment is expected to grow at the highest CAGR. With an ongoing trend towards digital transformation in the insurance industry, we can expect more and more insurance companies to adopt a software-as-a-service fraud detection model. The data these companies hold in the cloud creates scalability and flexibility to improve operations. As a result, low-cost and highly implementable detection capabilities that help with sustainability are expected to contribute to the growth of the industry during the forecast period. In addition, the growing focus on the cloud technology and integrated security features are projected to accelerate growth in the segment over the forecast period.

Regional Landscape

In 2023, North America held the largest revenue share in the market at 45%. Organizations like FICO, IBM, Oracle, etc play an important role in this market. Furthermore, stringent regulatory requirements and increasing incidences of fraud are driving industry demand for the insurance fraud solutions. As the nature of fraudulent activity morphs and adapts, insurance firms are allocating resources toward innovative solutions involving machine learning, artificial intelligence, and big data analytics. Additionally, collaborations of insurance organizations and technology companies encourage innovation and the development of consumer-specific solutions to address fraud challenges that differ across the North American insurance sector.

The fastest CAGR is expected in Asia Pacific insurance fraud detection market during the forecast period. As companies in the region take a proactive approach by investing in high end technology to reduce the number of insurance fraud cases. Furthermore, growing investment in better methods for governing and processing claims to ensure consumer satisfaction and allegiance is expected to contribute to regional expansion. In addition, broader awareness of fraud detection methods are expected to increase demand for fraud detection solutions. In addition, a nation like India, where the life insurance sector is on a boom, raises the need for organizations to deploy insurance fraud detection solutions to avert any kind of risk.

Access Full Report: https://www.snsinsider.com/reports/insurance-fraud-detection-market-4653

Recent Developments

March 2024: SAS Institute, a leading analytics firm, launched a new AI-powered fraud detection solution aimed at the insurance industry. This solution leverages machine learning algorithms to detect suspicious activity and prevent fraudulent claims in real-time.

February 2024: Verisk Analytics, a global data analytics provider, introduced a new fraud detection platform designed to identify potential insurance fraud in multiple sectors, including health and auto insurance. This platform uses big data and advanced analytics to provide insights into fraudulent claims.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release