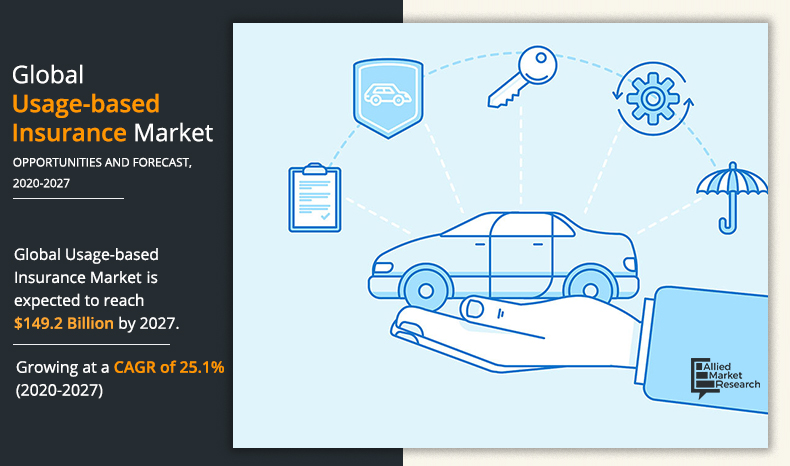

Usage-Based Insurance Market Is Thriving Worldwide as Revenue Size is All Set to Reach $149.2 Billion by 2027

Usage-Based Insurance Market 2022

PORTLAND, OREGON, UNITED STATES, January 11, 2022 /EINPresswire.com/ -- Usage-based insurance (UBI) is a telematics-based, auto insurance service that monitors cars, trucks, and other commercial or private vehicles, by keeping track of distance covered. The premiums are calculated according to the data assessed by the telematics device, which includes miles driven, time of day, where the vehicle is driven, rapid acceleration, and hard braking.

Allied Market Research published latest report, titled, “Usage-Based Insurance Market by Policy Type [Pay-As-You-Drive Insurance (PAYD), Pay-How-You-Drive Insurance (PHYD), and Manage-How-You-Drive Insurance (MHYD)], Technology (OBD-II-Based UBI Programs, Smartphone-Based UBI Programs, Hybrid-Based UBI Programs, and Black-Box-Based UBI Programs), Vehicle Age (New Vehicles and Used Vehicles), Vehicle Type (Light-Duty Vehicle (LDV) and Heavy-Duty Vehicle (HDV)): Global Opportunity Analysis and Industry Forecast, 2020–2027.” According to a report, the global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.10% from 2020 to 2027.

Download Sample Report (Get Full Insights in PDF - 250+ Pages) @ https://www.alliedmarketresearch.com/request-sample/1742

The Usage-based insurance market study provides a detailed analysis pertaining to the global market size & forecast, segmental splits, regional & country-level outlook, market dynamics & trends, Porters’ five force analysis, value chain analysis, competitive landscape, market share analysis, and patent analysis.

Segmental Outlook

The global Usage-based insurance market share is segmented depending on product type, application, end user, key players and region.

Segmental analysis is offered (real time and forecast) in both quantitative and qualitative terms. This helps the clients to identify the most lucrative segment to consider for their further investments, based on the comprehensive backend analysis about the segmental performance, in addition to brief understanding of the operating companies and their development activities with respect to the Usage-based insurance market.

COVID-19 Impact Analysis

The rapid spread of the coronavirus has had an enormous impact on the lives of people and the overall community. The report provides a brief overview of evolution of the coronavirus. In addition, it includes a micro- and macro-economic impact analysis. The report further showcases the market size and share depending on the impact of the COVID-19. Furthermore, reduction in the count of COVID-affected patients in the coming days with safety majors taken by governments and availability of vaccines are expected to gradually lower the impact of COVID-19 on the global Usage-based insurance market. Additionally, the report highlights the key strategies adopted by players during the global health crisis. Hence, the report provides an overview of pre- as well as post-COVID-19 impact analyses.

Get Detailed COVID-19 Impact Analysis on the Usage-based insurance market @ https://www.alliedmarketresearch.com/request-for-customization/1742?reqfor=covid

Market Opportunities

Usage-based insurance market players is witnessing remunerative opportunities for expansion in the near future.

Regional Outlook

The Usage-based insurance market trends is analyzed across four key regions, which include North America, Europe, Asia-Pacific, and LAMEA. The key countries contributing toward the growth of the market include:

• North America: U.S., Canada, and Mexico

• Europe: Germany, UK, Italy, Spain, France, and rest of Europe

• Asia-Pacific: India, China, South Korea, Japan, Australia, and rest of Asia-Pacific

• LAMEA: Brazil, Saudi Arabia, South Africa, and rest of LAMEA

Competitive Scenario

The major players profiled in the Usage-based insurance market report include, Allianz SE, Allstate Corporation, Aviva, AXA, Insurethebox, Liberty Mutual Insurance, Mapfre S.A., Nationwide Mutual Insurance Company, Progressive Corporation and UNIPOLSAI ASSICURAZIONI S.P.A.

The report profiles the top players operating across the globe along with market share analysis, and an outlook on top player positioning. In addition, the study focuses on the developmental strategies such as product launch, mergers & acquisitions, and collaborations adopted by the key players to maintain a competitive edge in the market space.

Interested to Procure the Data? Inquire Here @ https://www.alliedmarketresearch.com/purchase-enquiry/1742

Report Coverage

• Historic Data considered: 2016 to 2021

• Growth Projections: 2022 to 2027

• Major Segments Covering product type, provider, application, end user

• Market Dynamics and Usage-based insurance market Trends

• Competitive Landscape Reporting

Research Methodology

AMR offers its clients with comprehensive research and analysis based on a wide variety of factual inputs that majorly include interviews with professionals in the industry, regional intelligence, and reliable statistics obtained from multiple resources. The in-house industry experts play an important role in designing analytic tools and models, tailored to the requirements of the client for a particular industry segment. These analytical tools and models distill the statistics & data and enhance the accuracy of our recommendations and advice.

Key Market Segments

By Type

• Pay-as-you-drive (PAYD)

• Pay-how-you-drive (PHYD)

• Manage-how-you-drive (MHYD)

By Technology

• OBD-II-based UBI programs

• Smartphone-based UBI programs

• Hybrid-based UBI programs

• Black-box-based UBI programs

By Vehicle Age

• New Vehicles

• Used Vehicles

By Vehicle Type

• Light-Duty Vehicle (LDV)

• Heavy-Duty Vehicle (HDV)

By Region

• North America

o U.S.

o Canada

• Europe

o Germany

o France

o UK

o Italy

o Spain

o Belgium

o Rest of Europe

• Asia-Pacific

o China

o Japan

o Australia

o Singapore

o Thailand

o Rest of Asia-Pacific

• LAMEA

o Latin America

o Middle East

o Africa

Report Covered in 9 Chapters:

CHAPTER 1: INTRODUCTION

CHAPTER 2: EXECUTIVE SUMMARY

CHAPTER 3: MARKET LANDSCAPE

CHAPTER 4: USAGE BASED INSURANCE MARKET BY POLICY TYPE

CHAPTER 5: USAGE BASED INSURANCE MARKET BY TECHNOLOGY

CHAPTER 6: USAGE BASED INSURANCE MARKET BY VEHICLE AGE

CHAPTER 7: USAGE BASED INSURANCE MARKET BY VEHICLE TYPE

CHAPTER 8: USAGE BASED INSURANCE MARKET BY REGION

CHAPTER 9: COMPANY PROFILES

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of Market Research Reports and Business Intelligence Solutions. AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

David Correa

Allied Analytics LLP

help@alliedanalytics.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Distribution channels: Business & Economy, Insurance Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release