VT Department of Labor begins mailing of new 1099-G forms to 2020 unemployment insurance claimants

MONTPELIER – The Vermont Department of Labor (VDOL) announced today, that all new 1099-G forms have been reviewed and printed, and are set for mailing. The State began delivering the 180,000 pieces of mail to the U.S. Postal Service in Essex beginning Friday afternoon, with the last batch being delivered on Monday, March 1st. Claimants can expect to receive their 1099-G forms over the course of next week.

“I am pleased to announce that most claimants will be receiving their 1099s over the course of the next week,” said Commissioner Michael Harrington, “and I thank Vermonters for their patience as teams from across state government worked to get these out the door as quickly as possible.”

Claimants will receive a 1099-G form for each program they collected benefits from during the 2020 calendar year. This means many should expect multiple 1099-G forms if they collected benefits for most of the year, especially during the spring, summer and fall, and if their unemployment was a result of the COVID-19 pandemic.

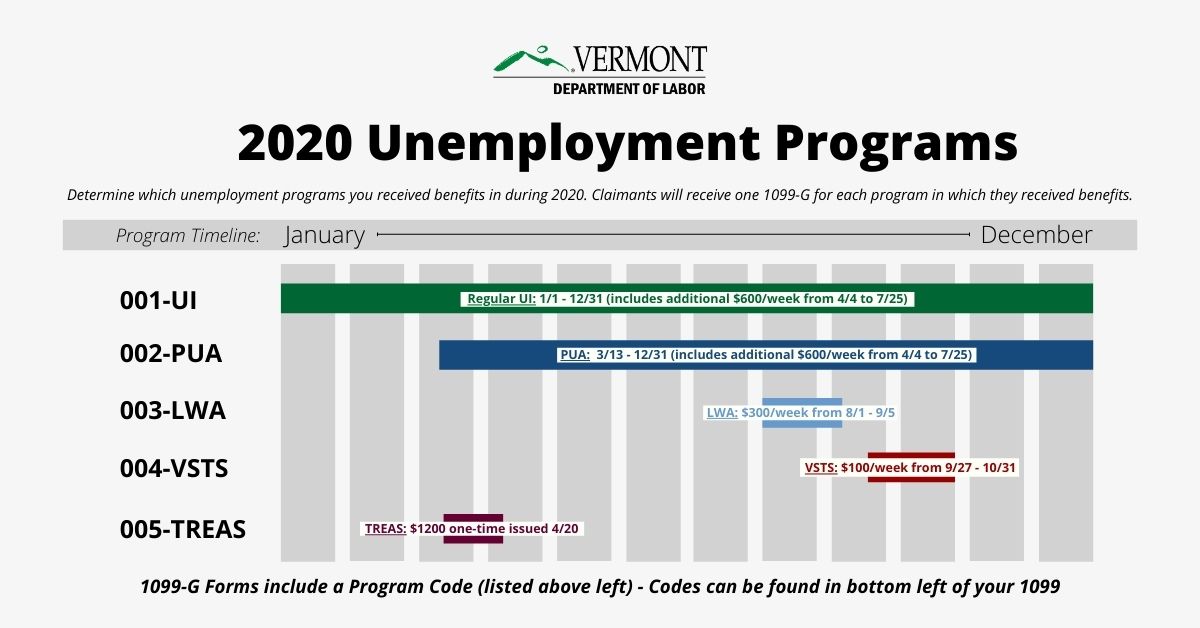

The Department of Labor administered nine different types of benefits through five different unemployment programs in 2020. Claimants can identify the program their 1099-G is for by using the code in the bottom left-hand corner of the tax document.

- 001-UI: This 1099-G represents regular Unemployment Insurance (UI) benefits received in 2020, including extended benefit weeks, and the additional $600 added to weekly benefits during April 4 through July 25.

- 002-PUA: This 1099-G represents Pandemic Unemployment Assistance (PUA) benefits received in 2020, including the additional $600 added to weekly benefits during April 4 through July 25.

- 003-LWA: This 1099-G represents Lost Wage Assistance (LWA) benefits received in 2020. This was a federal program which provided an additional $300 per week to eligible unemployment insurance claimants between August 1 and September 5. This payment was mailed in a check, separate from weekly benefit payments.

- 004-VSTS: This 1099-G represents Vermont Short Term Supplemental (VSTS) benefits received in 2020. This program provided an additional $100 per week to claimants between September 27 and October 31. This payment was mailed in a check, separate from weekly benefit payments.

- 005-TREAS: This 1099-G represents a one-time payment of $1,200 issued by the State on April 20. This was for Vermonters who had filed for unemployment insurance benefits between March 15 and April 4 but had not yet received any benefit payments.

Claimants had the option to have personal income taxes withheld when they enrolled in UI and PUA, however, taxes were not withheld from LWA, VSTS, or TREAS payments. That means claimants who received these benefits will need to pay state and federal income taxes on them.

Additionally, VDOL has worked to ensure information was correct to the best of its ability. However, if information on-file was provided incorrectly, or if claimants have moved or changed their names, the Department has established a process by which claimants may request an update or reissuance of 1099-G forms.

Claimants may still file their personal income tax return as long as they believe information included in Box 1 Unemployment Compensation, Box 4 and Box 11 withholding amounts, and the Last 4 Digits of Claimant Social Security Number to be correct. A typo in the name or an incorrect address does not prevent a claimant from filing taxes but may result in a delay in receiving a tax refund. In those cases, claimants may consider contacting the IRS and Vermont Department of Taxes to notify them of the incorrect name/address.

To submit a request or to get more information, claimants may call the Claimant Assistance Line at 1-877-214-3332, or go online to labor.vermont.gov/request-199-correction. The online form will be active once all 1099s have been mailed.

The Department will continue to provide updates to claimants through the postal service, email, and social media. More information can also be found online at labor.vermont.gov/1099-incident-updates. Claimants who do not have access to the internet can contact the Unemployment Insurance Clamant Assistance Center at 877-214-3332 and select ‘Option 1’ for updates on the 1099-G issue.

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.