Disabled and living on a fixed income, Kinga Carter strives to make every dollar count in the little northwest Omaha townhouse she shares with two yorkies, two cats and a couple cockatiels.

That’s why she was stunned last year when the homeowners insurance on her modest home increased 30%. That’s $400 she’s had to bear out of pocket. And it came despite the fact she reduced her coverage by doubling her deductible.

“My Social Security has not gone up that much,” the 65-year-old Omaha native said. “Nobody has gotten that much of a raise in that time.”

Carter is certainly not alone in her recent home insurance sticker shock.

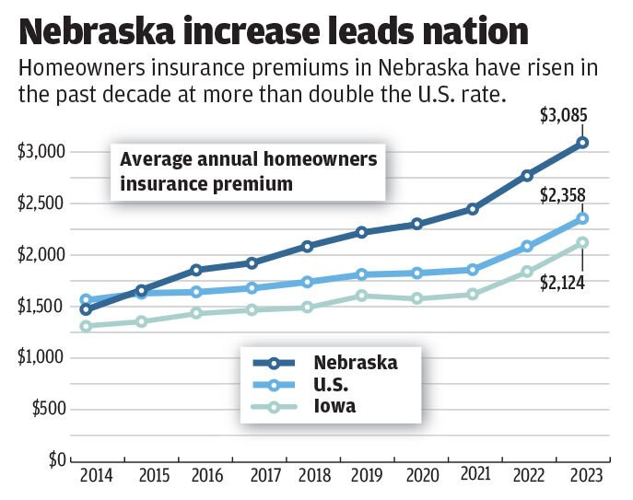

The average homeowners insurance premium in Nebraska has more than doubled over the past decade — the largest increase in the nation.

A recent study by business analytics firm S&P Global found the average Nebraska premium rose nearly 23% in 2024 alone. And a World-Herald analysis of data for the previous nine years shows the average premium skyrocketed over that time by 108%. Both of those spikes were the nation’s largest.

People are also reading…

While a number of factors have played into those jaw-dropping price increases, the biggest culprit has been our changing climate.

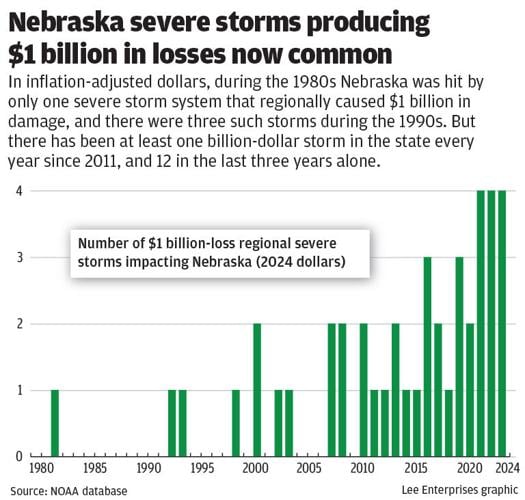

Across Nebraska, severe storms packing tornadoes, high winds and roof-pummeling hail have become dramatically more frequent during this century. Federal data on billion-dollar disasters shows the trend.

When the cost of past weather damage is adjusted for inflation, Nebraska during the 1980s and 1990s was hit by a total of four multi-state severe storm systems that packed at least $1 billion in damage.

Nebraska was hit by four such mega-storms in 2024 alone. There were four each in 2022 and 2023, too.

“A changing climate is shifting both the size of losses and where they are occurring,” said Benjamin Keys, a professor of real estate at the University of Pennsylvania’s Wharton School. “This is not just a story of hurricanes in Florida or wildfires in California. It’s a story of damage from hail and thunderstorms, and other types of weather-related storm damage.”

Eric Hunt, an extension meteorology educator with the University of Nebraska-Lincoln, said one of the first ways Nebraskans are paying for climate change is through higher home insurance premiums.

“We have had some pretty significant events,” Hunt said of recent storms. “It’s part of life here, and it’s not going to go away, and it’s probably going to get worse.”

Rising storms, rising costs

The damage toll has been adding up for homeowners and insurers alike.

In 2024 in Nebraska, home insurance providers paid out $1.36 in claims for every dollar collected in premiums, continuing a recent run of frequent annual losses.

Insurers have responded by jacking up prices, filing hundreds of rate increases with the Nebraska Department of Insurance.

Insurance is critical, protecting not only people’s homes, but for most families, their largest financial asset. And for most homeowners, those premiums are not optional but required by their lender if they hold a mortgage.

Home insurance premiums have now joined surging house prices, higher interest rates and ever-rising property taxes to create an even higher barrier to getting people into their own home.

Rep. Mike Flood, shown here speaking on Tuesday, Aug. 22, 2023, says homeowners can defend against rising insurance prices by using more impact-resistant roofing material to guard against hail.

“Things are snowballing in a bad way,” said Nebraska Congressman Mike Flood, a Republican who chairs the House subcommittee with jurisdiction over housing issues. Flood says insurers have told him that the companies they buy reinsurance from “have put a bullseye on Nebraska” because of the high storm claims.

Given Nebraska’s massive storm losses in 2024, Flood suspects Nebraskans have more premium price hikes to come.

“You are going to continue to see rate increases well in excess of the rate of inflation given the concern these companies have with exposure,” said Tim Zawacki, an insurance analyst with S&P Global.

Besides the increased churn of damaging convective storms, Zawacki and other experts cite additional drivers in higher insurance costs.

With the state’s shortage of homes, the value of existing homes in Nebraska is up more than 50% in the past five years. Simply put, the more a home is worth, the more expensive it is to insure.

The cost of building materials and labor are up more than a third since the pandemic, making the repairs for storm damage that much more expensive.

Given the current rate climate, experts say checking with multiple carriers is one way for consumers to ease the burden.

“That can be a mistake if you are not shopping around,” Keys said.

'It’s just mind-boggling'

Devin Tejral’s home in west Omaha is far from California’s earthquake fault lines and the hurricane landing zones of Florida.

Devin Tejral poses for a portrait at his home in Omaha, on Thursday, April 10, 2025. Tejral has seen his annual home insurance premium almost double since 2020.

Yet he’s seen his annual home insurance premium almost double since 2020, from $2,100 annually to $4,100. That’s despite shopping around and reducing his coverage.

“It’s just mind-boggling,” he said.

But at the same time, he’s also well aware of the recent propensity for severe storms to blow through the state.

His roof was replaced after a big hail storm in 2018. Then on April 26 last year, he stood on his back deck and watched a powerful tornado pass just two miles to the west. That twister ultimately destroyed nearly 200 homes and inflicted major damage to nearly 250 others.

Devin Tejral's roof on Thursday, April 10, 2025. Tejral replaced his roof after a recent hailstorm.

This month marks the one-year anniversary of that Arbor Day tornado outbreak, part of a multi-state storm system that inflicted more than $1 billion in damage across the region. And such storms are now hardly rare events.

In addition to the Arbor Day outbreak, Nebraska in 2024 alone was hit by three other multi-state, billion-dollar storms, according to data from the National Oceanic and Atmospheric Administration. And the state has been hit by at least one such storm every year since 2011.

A World-Herald analysis of other local measures offers other evidence of how sharply extreme weather has been on the rise.

Since 1973, wind speeds in Omaha have been monitored by an automated anemometer at Eppley Airfield. It has served as a constant sentinel of Nebraska’s changing climate.

Of the 50 strongest daily wind speed days recorded at Eppley since 1973 — all with gusts of 62 mph or higher — almost three-fourths have come since 2000. Half have been recorded just since 2010.

Such strong winds are themselves capable of uprooting trees and damaging roofs and other structures. But they are also often associated with severe storms that tend to also pack damaging tornadoes and hail.

An analysis of National Weather Service data on hail events in Douglas County also points to more frequent extreme weather.

From the 1950s until 2000, Douglas County averaged less than one severe storm per year that spawned hailstones of more than one inch in diameter. This century, the average has been more than 2 1/2 such storms annually.

“We have seen a giant increase in the amount of hail,” agreed Becky Adams-Selin, an Omaha-area resident who works as a hail scientist for Atmospheric and Environmental Research, a private climate science firm.

'Hail alley'

While images of tornado funnels and smashed homes tend to get most public attention, hail may be the biggest property damage threat posed by convective storms.

A severe thunderstorm that produced two-inch hail is seen over Omaha on Wednesday, June 12, 2024. Hail may be the biggest property damage threat and Nebraska has is seeing storms like these with more frequency.

As weather becomes more extreme, storms produce stronger wind updrafts, which form hailstones, suspend them in the air longer and allow them to grow larger. The hail can then rain down widespread damage to roofs, windows and siding.

Adams-Selin said of the $54 billion in damage nationally in 2024 caused by severe convective storms, it’s estimated 60% to 70% was attributable to hail. Nebraska has long ranked among the most hail-prone of states, located in a “hail alley” that runs through the Central Plains states.

While the Arbor Day tornado obliterated hundreds of homes, Nebraska insurance officials say some insurers have told them a significant majority of their claims were actually from hail.

Nebraska’s changing climate could present other threats to homes beyond convective storms.

Many in Nebraska probably wouldn’t consider wildfires like those that decimated southern California in January could happen here. But with the state’s propensity for both gusty winds and periods of drought, Hunt said they can’t be ruled out.

“What happened in California could happen here,” he said. “You could have neighborhoods go up.”

The state insurance department each year calculates a collective loss-ratio for home insurers, essentially the total amount of losses paid out divided by total premiums collected. It’s pure dollars in and dollars out, figures that don’t take into account the annual cost of operating the companies, including sales commissions, processing claims, marketing and worker salaries.

In six of the last 11 years, claims in Nebraska have exceeded premiums collected. The average ratio in Nebraska over the entire period was 88 cents on the dollar, well above the 64 cents nationally.

Industry observers say at that 88-cent figure, most Nebraska homeowners insurers were almost surely losing money. Given all the other costs of running an insurance company, industry analysts say companies are likely not profitable when the ratio gets above 65 cents.

'Nebraska is getting hit particularly hard'

Insurance companies hold reserves, carry reinsurance to more broadly spread risk, and are also diversified with other types of insurance products to help them survive such losses. But to remain solvent long term, they also need to replenish their reserves and properly price the risk they face.

That means rate increases.

“Nebraska is getting hit particularly hard, but (higher rates) are hitting all homeowners all around the country and the Midwest,” said Eric Dunning, director of the Nebraska Department of Insurance.

The World-Herald analysis found as the average insurance premium in Nebraska doubled between 2014 and 2023, Nebraska went from having the nation’s 31st highest average rate to seventh highest.

Hurricane-prone Florida continued to have the highest average premium, though Nebraska’s nation-leading growth rate has been much higher than Florida's. Several neighboring and regional states are also among the growth leaders in that time, including Colorado (second), South Dakota (third), Minnesota (sixth), Wyoming (seventh) and Iowa (13th).

Increased rates aren’t the only fallout from higher storm losses.

Cyrus Jaffery, CEO of Jaffery Insurance & Financial Services

Cyrus Jaffery, owner and operator of an independent insurance brokerage in southwest Omaha, said some of the companies he works with are also declining to write new business in Nebraska, citing the advice of their reinsurers.

Insurance companies are also changing their financial practices, particularly when it comes to roofs. Rather than paying the replacement cost of an older roof, insurers may depreciate it based on age and pay only its current cash value.

“They want more skin in the game from the consumer,” Jaffery said.

Flood attributed the premium increases in part to the aggressive and “predatory” marketing practices of some roofing companies.

After a storm, roofing companies often blanket impacted neighborhoods with sales representatives, offer free inspections and ask homeowners to sign a power of attorney to handle their claim through the insurance process.

“Those claims kept going and going and going, and now they’ve caught up to us,” Flood said.

Shifting costs between states

A study by researchers from Harvard, Columbia and the Federal Reserve in 2022 suggested another possible reason some states are seeing higher insurance premiums: cost-shifting among insurers from consumers in one state to those in another.

High winds uprooted a tree that damaged a house near 42nd and Pacific Street in Omaha on Wednesday, July 31, 2024.

The homeowners insurance market nationality is regulated on a state-by-state basis. And as state regulatory agencies seek to balance affordability with assuring the solvency of insurers, some states scrutinize rate increases more aggressively than others.

Nebraska is among the states that generally let the market determine rates. Under Nebraska law, insurance companies are required to report rate changes to the insurance department but aren’t required to get approval. The state can intervene on prices if it finds a market is no longer competitive.

The 2022 study found that when higher-regulation states provide “friction” that keeps rates from adjusting with growth in losses, insurers respond by raising rates in less regulated states. The study estimated as much as 30% of increased costs in less regulated states could come from that shifting.

Nebraska insurance officials dispute cost-shifting has been a factor here, noting the big payouts and losses insurers have faced and competition in the Nebraska market.

“If an insurer prices its insurance higher than its competitors, it will lose business and money,” the department said in a statement.

It also said insurers’ ability to respond to losses also prevents the wholesale market withdrawals seen recently in states like California and Florida.

Steven Shultz, a professor of real estate with the University of Nebraska at Omaha, said he’d have to see more detailed data than the total loss-ratio figures Nebraska releases before he was convinced of the reasonableness of Nebraska rates.

And for competition to keep rates down, Shultz said, homeowners need to comparison shop. He questioned whether many do, since their premium payments are usually part of their mortgage, and many bundle their home and auto insurance with a single carrier.

“My guess is that people only shop around for rates when buying a new home or when there is a drastic rise in rates,” he said.

Flood put the onus on states like California that are making it harder for insurance companies to set prices appropriate to their risk.

“In Nebraska, we let the market work, and we let insurers price the risk, and sadly, those risks have gone up,” he said. “California's ‘friction’ has not resulted in anything but misery for homeowners and an exodus of insurers from the state that has hurt competition.”

Looking forward

The Environmental Defense Fund recently highlighted how climate change has contributed to the nation’s astronomical insurance premium increases. It called for a number of measures, including “investing in our future by cutting climate pollution now.”

That message comes as President Donald Trump and Republicans in Congress are pushing to cut billions of dollars in programs aimed at reducing carbon emissions while also boosting fossil fuel production. Trump is also reportedly seeking to slash funding for research into deadly weather.

Flood said a “philosophical” debate over climate change is not going to produce solutions for homeowners. He mentioned a number of measures that could reduce the bite of homeowners insurance, including seeking to reshore some of the reinsurance market that is located overseas and spurring more home development to reduce home price inflation.

Hail stones sits on a garbage bin in Omaha on Tuesday, June 25, 2024.

Flood and others also say using more impact-resistant roofing material to guard against hail may be one of the most impactful things property owners can do.

“There has been innovation in roofing materials that can withstand the intensity of hail in Nebraska,” Dunning said.

Not only do insurers typically offer a discount for putting on a more hail resistant roof, eliminating that common threat might also allow homeowners to increase their deductible, which would save them even more on rates, Flood said.

For consumers, it also never hurts to shop around to see what prices other companies are offering.

Jaffery said when his brokerage shops for customers, they often find a better deal, though it often still represents some level of rate increase. Rates don't compare to where they were two or three years ago.

At some point, Jaffery said, rates should catch up with storm losses in Nebraska and the market should stabilize. But until then, he expects most people renewing policies this year will continue to see rate increases.

“At the end of the day,” he said of insurers, “they have to make money in some capacity.”

Photos and videos: Cleanup begins after April 2024 storms, tornadoes hit Omaha metro area, Iowa

A look at Minden, Iowa on Saturday, April 27, 2024, after a tornado ripped through the town in Eastern Iowa.

Damage is seen to the Uleman's home near 216th and Maple Streets in Omaha, on Saturday, April 27, 2024. A tornado damaged the home on Friday.

Looking south toward the Elkhorn neighborhood, evidence of a Friday tornado is evident on Saturday, April 27, 2024.

Houses were damaged from a Friday night tornado at Newport Landing in Bennington, photographed on Saturday, April 27, 2024.

Emergency personnel clean up after a tornado ripped through Minden, Iowa on Friday evening. Photographed on Saturday, April 27, 2024.

Aubrey Attanasio, 12, bottle feeds a calf as her dad, Tony Attanasio, of Persia, Iowa, clears a broken cattle fence as they and other friends, family and coworkers help clean up the damage on Jared and Tory Crozier's property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Friends, family and coworkers help clean up the damage on Jared and Tory Crozier's property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Tory Crozier, 30, cleans up the damage after a tornado ripped through her family's property near Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Debris is spread all over Jared and Tory Crozier's property as friends, family and coworkers help clean up the damage after a tornado ripped through Minden, Iowa on Friday evening. Photographed with a drone about a mile south of Minden on Saturday, April 27, 2024.

Tony Attanasio, 37, of Persia, Iowa, gives water to cattle as he and other friends, family and coworkers help clean up the damage on Jared and Tory Crozier's property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Lillian Crozier, 9, bottle feeds a calf as friends, family and coworkers help clean up the damage on her family's property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Friends, family and coworkers help clean up the damage, including a destroyed RV, on Jared and Tory Crozier's property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Jon Alexander, bottom left, walks back to his house at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the roof and trees on the property.

Damage from a tornado the day before is visible at Eppley Airfield in Omaha on Saturday, April 27, 2024.

OPPD trucks line up to restore power at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the property the day before.

Workers repair the roof of the house at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the property the day before.

Workers clean up the debris at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the property the day before.

Workers repair the roof of the house at Sycamore Farms in Waterloo on Saturday, April 27, 2024.

Emergency personnel clean up the damage after a tornado ripped through Minden, Iowa on Friday evening. Photographed on Saturday, April 27, 2024.

Emergency personnel clean up the damage after a tornado ripped through Minden, Iowa on Friday evening. Photographed on Saturday, April 27, 2024.

Debris is spread all over Jared and Tory Crozier's property as friends, family and coworkers help clean up the damage after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

A tornado ripped through Minden, Iowa on Friday evening. Photographed with a drone on Saturday, April 27, 2024.

Workers clean up the debris at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the property the day before.

A large tree was uprooted and cut at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the property the day before.

Workers clean up the debris at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the property the day before.

Damage is visible at Sycamore Farms in Waterloo on Saturday, April 27, 2024. A tornado damaged the property the day before.

Items for Junkstock were damaged after a tornado hit Sycamore Farms in Waterloo the day before, photographed on Saturday, April 27, 2024.

Debris is spread all over Jared and Tory Crozier's property as friends, family and coworkers help clean up the damage after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Tory Crozier's greenhouse is damaged after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Dead chickens are found throughout a property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Debris is spread all over Jared and Tory Crozier's property as friends, family and coworkers help clean up the damage after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Friends, family and coworkers help clean up the damage on Jared and Tory Crozier's property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Debris is spread all over Jared and Tory Crozier's property as friends, family and coworkers help clean up the damage after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Kasey Bradley, 42, of Portsmouth, Iowa, and Nolan Driver, 23, of Neola, Iowa, clean up the damage on a property after a tornado ripped through Minden, Iowa on Friday evening. Photographed about a mile south of Minden on Saturday, April 27, 2024.

Drivers wait to try and enter Minden, Iowa after a tornado ripped through on Friday evening. Photographed just west of Minden on Saturday, April 27, 2024.

Iowa state troopers guide drivers trying to enter Minden, Iowa after a tornado ripped through on Friday evening. Photographed just west of Minden on Saturday, April 27, 2024.

A room was damaged by a tornado on a building used for Junkstock after a tornado hit Sycamore Farms in Waterloo the day before, photographed on Saturday, April 27, 2024.

Items for Junkstock were damaged after a tornado hit Sycamore Farms in Waterloo the day before, photographed on Saturday, April 27, 2024.

A road sign is bent after a tornado the day before near Highway 28 in Waterloo on Saturday, April 27, 2024.

Trenton Guardipee, left, and Caiden Marksmeier help stack tree debris at Sycamore Farms in Waterloo on Saturday, April 27, 2024. Both are students at Douglas County West.

People stand on the roof a house damaged by a tornado near 240th and Center Streets near Waterloo, Neb. on Saturday, April 27, 2024. The power lines in his area sustained a heavy damage.

The top of a pole for a power line was snapped off by a tornado the night before near 240th and Center Streets near Waterloo, Neb. on Saturday, April 27, 2024.

Irrigation equipment was flipped by a tornado near 252nd and F Streets near Waterloo, Neb. on Saturday, April 27, 2024.

Cleanup continues in the Ramblewood neighborhood of Elkhorn.

Cleanup continues in the Ramblewood neighborhood of Elkhorn.

Cleanup continues in the Ramblewood neighborhood of Elkhorn.

Cleanup continues in the Ramblewood neighborhood of Elkhorn.

Volunteers Kelly Storejohann (left) and Deb Hurst fold donated clothes at First Lutheran Church in Blair on Saturday afternoon.

Michael Cawcutt checks out a wayward floating dock at Bennington Lake in the Newport Landing neighborhood in Bennington, Neb. on Saturday, April 27, 2024. The dock had come to rest on the west of the lake, but Cawcutt, who is the Newport Landing home owners association president, wasn't sure what part of the lake the tornadic storm from the day before moved it from.

Michael Cawcutt checks out a wayward floating dock at Bennington Lake in the Newport Landing neighborhood in Bennington, Neb. on Saturday, April 27, 2024. The dock had come to rest on the west of the lake, but Cawcutt, who is the Newport Landing home owners association president, wasn't sure what part of the lake the tornadic storm from the day before moved it from.

Houses were damaged from a Friday night tornado at Newport Landing in Bennington, photographed on Saturday, April 27, 2024.

Andrea Kathol cleans up debris out of Bennington Lake at Newport Landing in Bennington on Saturday, April 27, 2024. A tornado damaged homes in the Newport Landing neighborhood the night before.

A Friday tornado damaged the Uleman near 216th and Maple Streets in Omaha, photographed on Saturday, April 27, 2024.

A Friday tornado damaged the Uleman near 216th and Maple Streets in Omaha, photographed on Saturday, April 27, 2024.

A Friday tornado damaged filled the bathroom sink with insulation inside the Uleman near 216th and Maple Streets in Omaha, photographed on Saturday, April 27, 2024.

A Friday tornado damaged the Uleman near 216th and Maple Streets in Omaha, photographed on Saturday, April 27, 2024.

A Friday tornado damaged the Uleman near 216th and Maple Streets in Omaha, photographed on Saturday, April 27, 2024.

Clothing is hanging from a tree near 216th and Maple Streets after a Friday tornado in Omaha, photorgaphed on Saturday, April 27, 2024.

An OPPD worker repairs power lines damaged by a tornado near 216th and Maple Streets in Omaha on Saturday, April 27, 2024.

An OPPD worker repairs power lines damaged by a tornado near 216th and Maple Streets in Omaha on Saturday, April 27, 2024.

Misty Homen,left, and Andrea Kathol cleansup debris out of Bennington Lake at Newport Landing in Bennington on Saturday, April 27, 2024. A tornado damaged homes in the Newport Landing neighborhood the night before.

Andrea Kathol cleans up debris out of Bennington Lake at Newport Landing in Bennington on Saturday, April 27, 2024. A tornado damaged homes in the Newport Landing neighborhood the night before.

Volunteers clean up debris at Newport Landing in Bennington, Neb. on Saturday, April 27, 2024.

From left, Gary ,Clay, and Jill Uleman pose for a portrait in the tornado-damaged second floor of their house near 216th and Maple Streets in Omaha on Saturday, April 27, 2024. Gary and Jill are Clay's parents.

OPPD workers repair power lines damaged by a tornado near 216th and Maple Streets in Omaha on Saturday, April 27, 2024.

Houses were damaged from a Friday night tornado at Newport Landing in Bennington, photographed on Saturday, April 27, 2024.

Houses were damaged from a Friday night tornado at Newport Landing in Bennington, photographed on Saturday, April 27, 2024.